What is a budget planner?

A budget planner is a tool that allows you to track your income and your expenses. It's a great way for you to get a better understanding of where your money is going.

As we grow older and become more independent, the one thing we all need to contend with is money. Being able to keep track of your finances, take charge of your spending and develop long-term plans with your savings is a key responsibility to have as an adult.

A budget planner can help you accomplish all those and more.

Why use a budget planner?

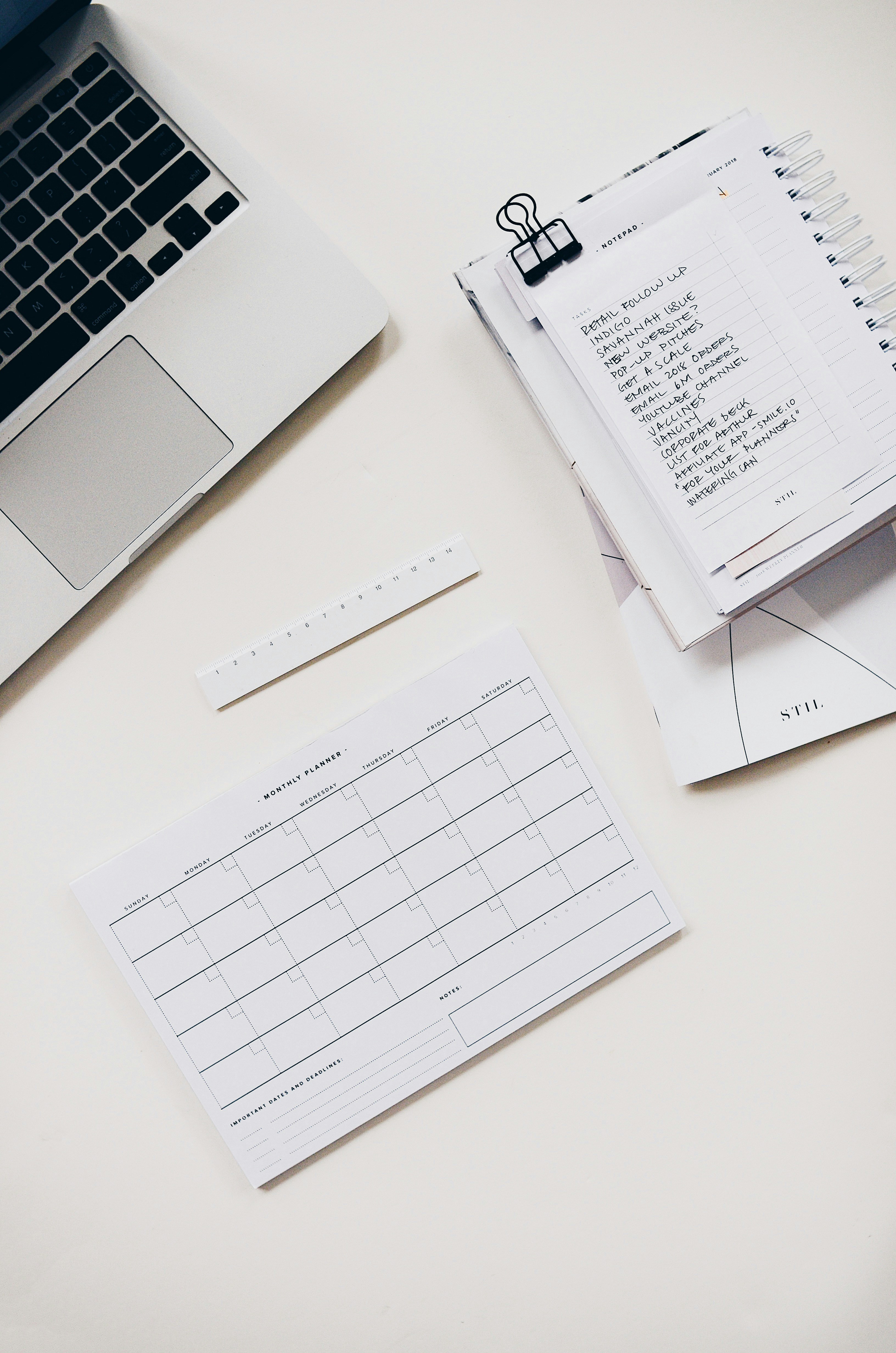

Photo by Mediamodifier on Unsplash

1. Controls your expenses

According to a study conducted in May 2020 by Mint, 3 out of 5 Americans did not know how much they spent the previous month. With a budget planner, you can get better clarity of how much you're spending every month and what you're spending on.

When you have a clear record of your activities and expenses, you'll be able to make the necessary adjustments to help you keep within your budget in the next month.

2. Work towards your financial goals

We all have financial goals, some less concrete than others. A budget planner encourages you to set specific financial goals and gives you a framework to achieve them.

Whether you're looking to clear your debts, get a better credit score, or become a millionaire in the future, a budget planner helps you to plan it all out in a systematic way.

3. Lead a more frugal lifestyle

You may be surprised at just how much you spend in a month. Subscription services, transport costs, clothes you purchase online — these all add up and may cost you more than you would have thought.

A budget planner will help you become more aware of what you're spending on, so that you can cut down on these unnecessary expenses accordingly.

How to plan your budget

If you're interested in getting into the habit of budget planning and money management, that is just 1 half of the battle complete. Here are the next steps that you should take in order to get started on the journey of budget planning.

1. Set your financial goals

To start with, you will need to decide on and set your financial goals. It will be helpful to separate them into short term and long term goals. After all, your financial goal in 10 years will not be the same as your financial goals for the end of the year.

Consider setting your goals with the following timeframes in mind:

- 10 years

- 5 years

- 1 year

- 1 month

Starting your budget plan with your financial goals gives you a direction to work towards.

2. Track your expenses & activity

As mentioned earlier, a budget planner will be a useful tool in helping you keep track of your spending and what you're spending on.

You will be surprised at just how much you spend every month, and how many things you can easily eliminate from your expenditure to help you save more money!

You should begin by listing down your fixed expenses. These include monthly bills such as rent, car payments and utilities. These are expenses that you will most likely be unable to cut back on, and so you must arrange your budget around these expenses.

Then, write down your variable expenses, such as money spent on groceries, food, entertainment, et cetera. Consider noting down all your expenses at the end of every day to ensure that you're as accurate as possible.

3. Make a plan

In order to help you reach your financial goals, it's important to make an action plan. For example, you may want to determine how much you aim to save every month, and budget your money accordingly!

Consider setting a monthly savings goal at the start of every month, and then determine how much you've been able to stick to your goal.

These records will give you an idea of what you should do in order to stick to your financial goals. For example, if you've been spending more than planned, then you may need to re-evaluate your spending and cut down where possible.

4. Manage your savings

Photo by Fabian Blank on Unsplash

Just as it's important to keep track of your expenses, it is also important to keep track of your savings.

It's easier to lose track of your savings than you might think. You may have money put away in different bank accounts and even in different e-wallets. By keeping track of your savings, you'll also be able to ensure that you have an emergency fund for rainy days.

Once you're at a comfortable amount with your savings, you may also want to start paying off debt or making investments.

5. Keep checking in

You should constantly review your income, spending and saving. Ideally, you should review your spending and budget every week or two, but real world responsibilities may take more of your time than expected. At the very least, try to do a monthly review of your spending and savings!

Do also consider taking a year-in review of your budget to give you a bird eye view of your finances across all 12 months. This will allow you to get a better sense of how well you've stuck to your budget, and what changes you need to make in order to do better or maintain your performance in the next year.

Conclusion

Photo by Tyler Franta on Unsplash

Budget planning is an important skill to have, but it can be rather intimidating on your first try. The last thing you'll need to is to deal with the hassle of coming up with your own budget planning sheets.

Luckily, there are many budget planners — fully designed, formatted and organized — available for your choosing out there! Whether you prefer budget planning in a traditional physical notebook, or using a digital planner on a tablet, a budget planner is the perfect way for you to start managing your finances!